OTT and CTV in LATAM seem to be entering a period of rapid and sustained expansion: As networks improve their traffic capacity.

Often unfairly overshadowed by its northern neighbor, Latin America is a huge market for the video industry itself, with a population of some 639 million. Decades of relative political stability have led to sustained economic growth and investment in infrastructure, and its GDP has increased almost fourfold in the last quarter-century.

This makes it increasingly fertile ground for OTT services. According to the latest Digital TV Research report on the region, OTT TV and Video Forecasts in Latin America, OTT revenues are expected to grow an impressive 160% over the six years from 2017, reaching a total of $6.43 billion in 2023.

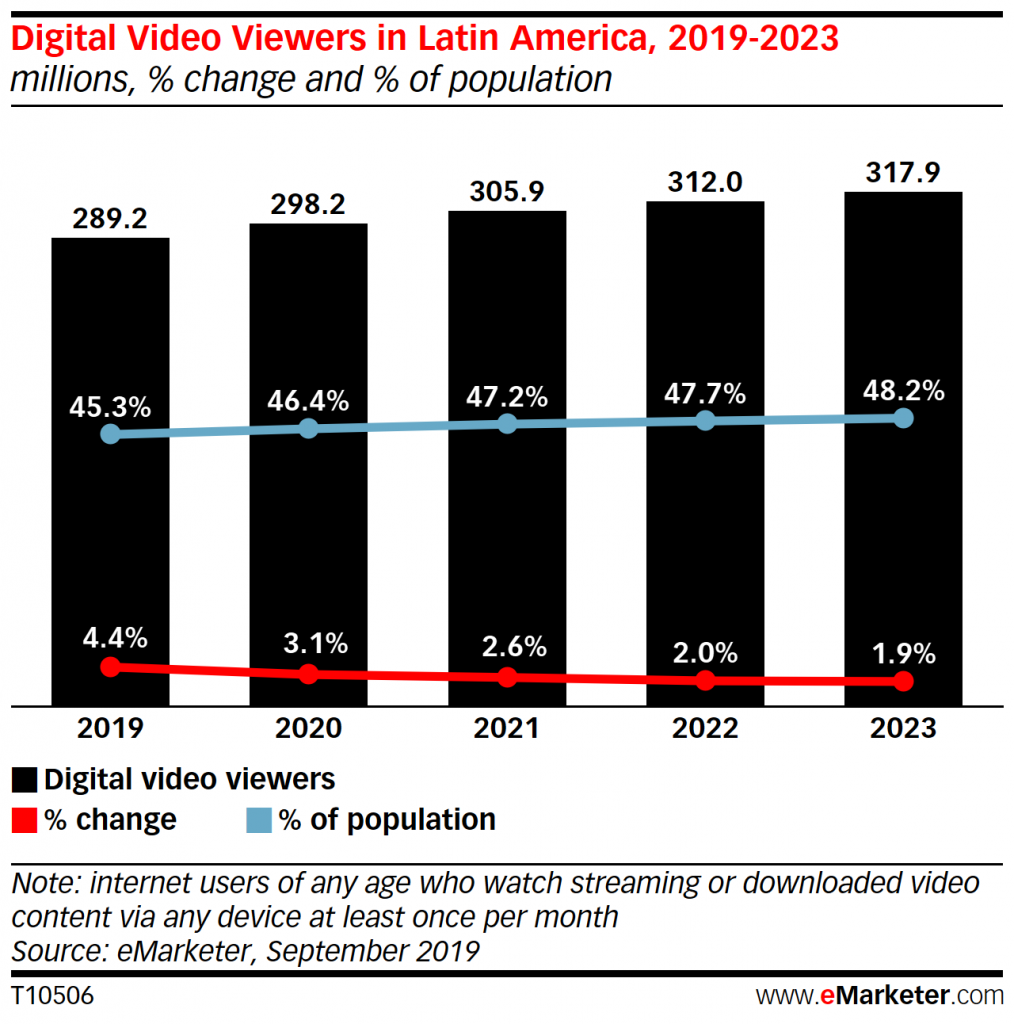

The SVoD (Subscription Video on Demand) is the main driver here, representing about two-thirds of that total. This is due to a rapidly expanding subscriber base, which will more than double to 48.24 million viewers in the same period.

Of course, this is not an even picture. The five largest economies in all of LATAM will contribute over 80 percent of revenues, although this is perhaps more a reflection of the region’s varying population sizes than anything to do with economic disparities (although these do exist).

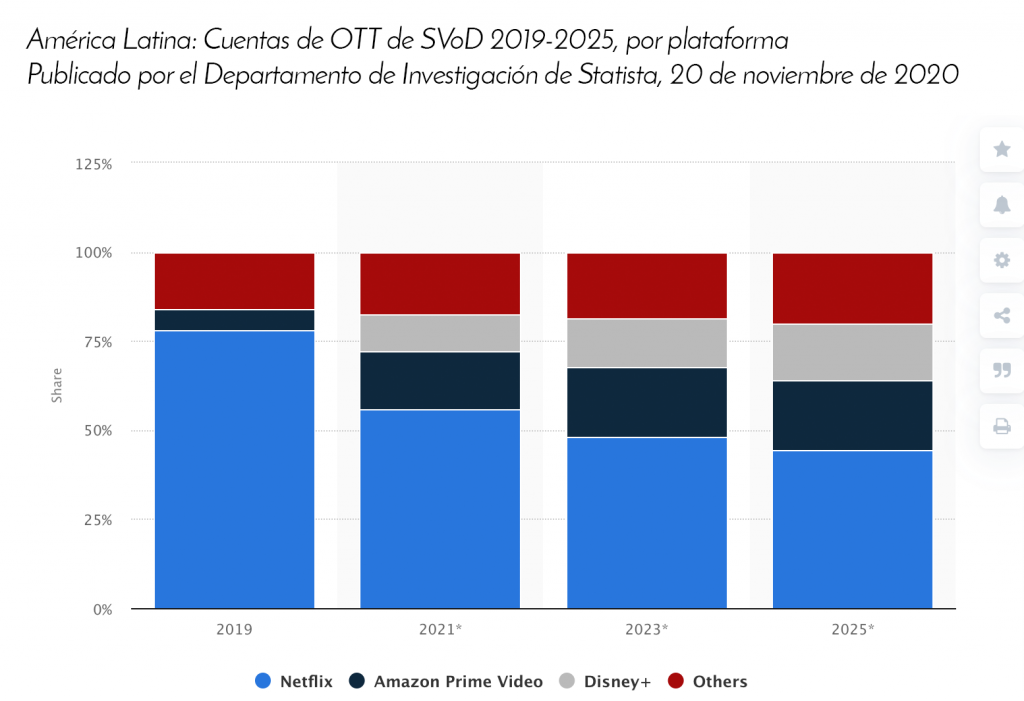

Recently, the region has been increasingly targeted by large North American SVoD services, although Netflix is realizing that it has not captured the market in its own way. In fact, Digital TV Research believes that its market share is declining even as the total number of subscribers increases, accounting for about half of the region’s paid subscribers by 2023, down from a peak of two-thirds in 2017.

So where are the opportunities in the region? What factors are driving markets throughout LATAM, and what challenges do you still face? Can you overcome a frustrating history of poor broadband provision?

OTT Measurement

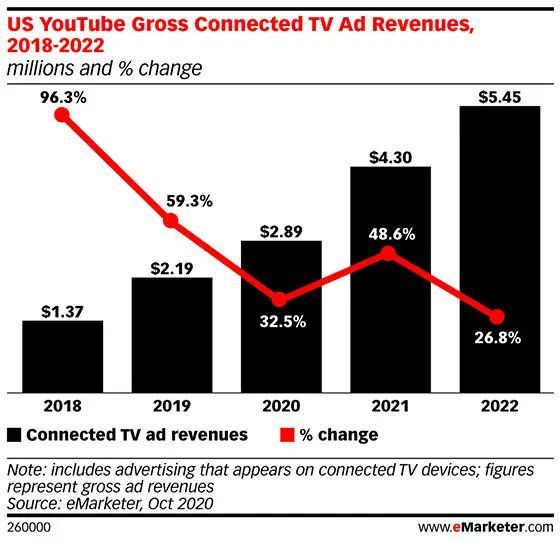

According to a study by the Winterberry Group, investment in streaming video advertising will increase by 20 percent in 2019, reaching $2.6 billion. However, these figures are still low compared to television advertising spending, and measuring reach is the biggest challenge for OTT services.

Television industry professionals believe that television metrics are more valuable than those of an OTT service because each service has its own metrics and content is consumed across multiple devices and platforms, making measurement much more variable.

In the case of television, advertisers are guided by Nielsen ratings.

Although it is much easier to run a television campaign, OTT campaigns have other advantages, such as audience segmentation.

The latest eMarketer forecast states that 204.9 million Americans will see OTT content in 2019. Users will spend 92.43 minutes per day watching digital videos in 2019.

Interest in digital video is growing rapidly among users and advertisers, but some professionals are still undecided until reach measurement becomes more diverse and agile.

Source: https://www.viaccess-orca.com/blog/ott-delivery-latam, https://digitalpolicylaw.com/medicion-el-desafio-de-la-publicidad-en-ott-frente-a-la-tv/